Last January, my wife was admitted to the hospital and later diagnosed with ulcerative colitis. In July, she was told she had bladder cancer and a fistula that had created a path between the colon and bladder (resulting in feces in the urine). A urologist and colorectal doctor planned to do surgery sometime in August. On August 1, I rushed Polly to the emergency room. Her catheter had come out — more precisely, blown out — and she was, to put it bluntly, shitting all over herself and the floor. After six days at the Community Hospital and Wellness Center (Bryan Hospital), the surgeons decided Polly’s surgery would have to be done at Parkview Regional Medical Center in Fort Wayne, Indiana.

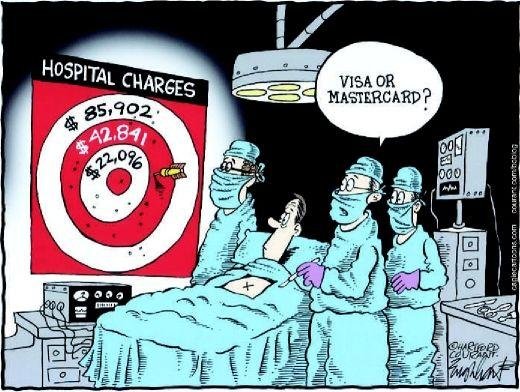

Late on August 6, Polly was transferred by Williams County EMS — the only ambulance service in the county — to Parkview. Polly would later have successful bladder and colon surgery. All told, she spent eighteen days in the hospital. Total cost for the January and August hospitalizations? $200,000. And that’s what our insurance paid, not what the various service providers billed. The sheer amount of the billings and various providers is mind-boggling, even to a man who spent most of his adult life handling church and secular business finances.

Our annual insurance deductible is $3,400. Our maximum out of pocket is $6,750. On top of that, we pay $84 a week for family medical coverage. Polly’s employer pays another $19,000 a year to provide our family insurance. This means that we personally paid $11,118 this year for medical expenses. Add what Polly’s employer pays to this amount, and our total medical costs exceed $30,000. And, all praise be to the God of American Capitalism, this starts all over again come January 1. Well, with one change: our insurance premiums go up again, as they have most years over the past two decades! (Some years, premiums remained the same, and deductible and out of pocket maximums were increased. Over the past two decades, our deductible has increased 1,000% and our family maximum out of pocket has increased over 500%)

Polly’s surgeries were a success. Last Friday, she had a colonoscopy to determine whether her colectomy could be reversed. The surgeon reported that her colon was free of inflammation and that the colectomy could be reversed. Surgery is planned for March 2020. The bladder cancer? The pathologist made a “mistake.” Polly doesn’t have cancer. The pathologist’s negligence caused untold grief for us. His error triggered a hospital-level tumor board review. The urologist who resected Polly’s bladder sent tissue samples to the University of Michigan for examination. The samples were cancer-free.

Polly having surgery in March 2020 means, of course, that we will have to meet our annual insurance deductible and maximum out of pocket again. This means that, once again, we will spend $11,118 for medical costs. Of course, this has been the norm more years than not for us over the past decade. The only difference this year is that it is Polly’s medical bills, and not mine, that are running up the tab.

And, that’s not all . . . (think of Billy Mays doing a late-night OxiClean infomercial).

We have almost $3,000 of medical bills that the insurance company didn’t pay. I spent several hours on the phone today, trying to figure out why these bills weren’t paid. Right now, my emotions run the range of going postal and weeping, wondering when we will get out from under the weight of medical costs. The EMS bill balance of $965 is ours to pay (the total billed amount for transport was almost $1,900). Polly’s transport was medically necessary and Williams County EMS was the only provider in the county. What were we to do, right? I asked both the hospitalist and nurse to make sure that the transport was covered by our insurance. They assured me that it was. And it was, with one big fuck you. Williams County EMS accepts our insurance, BUT they do not accept insurance adjustments and assignments. Polly’s insurance company paid what Medicare customarily pays, leaving us with a substantial balance. I am also dealing with pathology and radiology bills that were rejected by the insurance company due to incomplete paperwork, lack of reports, etc. Trying to find someone who could actually “fix” these problems for me proved futile. It’s up to me to contact the various players and make sure proper documents are submitted to the insurance company.

The American healthcare system is broken. And it will remain this way until our government leaders are willing to overhaul the system and take the profit out of medical care. As long as insurance companies and large “non-profit” health care providers are in the driver’s seat, we shouldn’t expect change. In the meantime, all I know to do is send out monthly checks of $25, $50, and $100 to service providers as payment for our outstanding balances. One provider, Parkview Hospital and Physicians Group, refuses to accept payments for more than a twelve-month period. Owe them $2,400? Your monthly minimum payment is $200. Yes, they offer bill reduction if you are poor, but unfortunately, we are just over income line they use to determine eligibility. Our local hospital, thankfully, did provide us a partial bill reduction (and was, overall, substantially cheaper than Parkview). They also don’t demand exorbitant monthly payments. We have been paying them $100 a month for, it seems, forever.

I know our story is not any different from those of other Americans facing serious medical problems. We are held captive by a system that prioritizes profit over care; a system that is almost impossible to navigate. Until government leaders put the healthcare needs of their constituents first, we shouldn’t expect things to change. While the Affordable Care Act was a step in the right direction, Congress, along with the Federal Courts, are going out of their way to burn “Obamacare” to the ground. President Trump and Republicans promised Americans awesome health insurance if the Affordable Care Act is invalidated. I can safely say that no such “awesomeness” is forthcoming. For the Gerencsers, 2020 will be yet another year of mounting healthcare costs; just as it will be for millions of Americans. We are all dying, one medical bill at a time.

On October 2, 2019, Michael Hicks. professor of economics and the director of the Center for Business and Economic Research at Ball State University, wrote an editorial in the Fort Wayne Journal Gazette castigating Parkview and other Indiana Hospitals for their excessive medical care costs. (We live in rural northwest Ohio. Toledo and Fort Wayne are our “big” cities, 40 miles or so in either direction.) Here’s what Hicks had to say:

Several weeks ago, a concerned citizen sent me a financial summary of Indiana’s not-for-profit hospitals. He asked that I look into the issue of excessive profits by these systems.

I was skeptical that the issue would be relevant. Profits are critical to an economy; they serve as a guide to pricing and investment decisions and reward the men and women who create value. The demonization of profits is a sure sign of unformed thought. Moreover, not-for-profit hospitals have explicitly chosen to forgo profits as part of their operations, so I doubted the financial summary would reveal anything important.

I was mistaken.

What I discovered will deeply anger every Hoosier and should embarrass most hospital administrators and board members. I also expect it to cause significant changes to state policy with respect to these hospitals. This is likely to change the way we tax them, regulate their competitors and enforce antitrust laws. It will surely lead to civil litigation involving billions of dollars of excess profits.

It turns out the not-for-profit hospital industry and its network of clinics is the single most profitable industry in Indiana. These profits are so large that, when accumulated, they account for roughly 9% of the state’s total economy. As of 2017, this industry had accrued more than $27 billion – yes, billion. Yet, the not-for-profit industry in Indiana pays virtually no taxes and invests almost none of those profits locally. That money is invested in Wall Street, not Main Street.

However, they do charge Hoosiers a premium to access health care.

Earlier this year, a Rand Corporation study found that hospitals in Indiana were charging among the highest prices in the nation. While the hospital association has been fighting this excellent study, it is surely correct. I am confident the Rand study is right because I mapped these hospitals and compared the Rand price data with the lack of competition in each health care market.

In places where there is little competition, such as Fort Wayne, consumers pay more than twice the cost for a typical medical treatment as they do in places with the most competition. This is how these hospitals accrued excess profits that are roughly 12 times larger than the entire state of Indiana’s Rainy Day Fund.

This windfall of profits has happened fairly recently. In 1998, the typical Hoosier spent $330 less than the average American for health care. We now pay $819 more per person than does the average American. The only factor that can explain this is growing monopoly power among our not-for-profit hospitals.

If you are not shocked by this, nothing can shock you. In a typical post-recession year, these excess profits were so large that they shaved almost 30% off economic growth in the state. Let me highlight some particularly egregious examples.

Parkview Hospital is the most blatant example. In one recent year, Parkview Hospital in Wabash earned a 48% profit rate. By comparison, Walmart, which also has a store in Wabash, had a profit rate of 3.12% that year. Parkview Hospital’s profit absorbed a full 4.1% of the county’s gross domestic product.

Using data from a ProPublica investigative website, I found IU Ball Memorial Hospital enjoyed a lavish 23.8% profit in that year. This was more than $100 million, or a full 2.5% of the county’s GDP. Despite this, the president of Ball Memorial recently begged the city of Muncie to subsidize new luxury apartments so his doctors could live downtown.

That subsidy will cost Muncie Community Schools more than $2 million, which just so happens to be about two days of profits at the not-for-profit IU Ball Memorial Hospital.

There are literally dozens of other outrageous examples reflecting an appalling lack of governance at not-for-profit hospitals.

To be fair, there are a few hospitals that choose not to participate in this plunder of their patients and communities. These good actors, along with the not-for-profit community as a whole, are hapless victims of this outrageous monopolization of health care in our state. I feel especially sorry for the faith-based community which will surely be linked unfairly to some of these institutions. They should be among the first to call for legislative intervention and governance change in these hospitals.

Local governments are also victims. The most profitable industry in our state pays no property tax and no income tax, but overcharges schools, and city and county governments for health care. There is almost certainly a tax reckoning coming for not-for-profit hospitals, which will add much to the coffers of local government.

Maybe the only good news in all of this is that this situation is a plaintiff attorney’s dreamscape. There is a $27 billion settlement pool alongside the most abundant evidence of anti-competitive behavior I have ever seen. If you lead a school, business or municipal government that has paid health care expenses in Indiana, find a good trial lawyer, or better yet a class-action specialist.

This news about Indiana is now attracting national attention as an example of a health care system run amok. This is the most shocking thing I have seen in more than two decades of public policy research.

Monopoly pricing at hospitals is likely a contributor to our state’s nearly 10-place decline in health rankings over the past two decades.

The most similar modern phenomenon I have witnessed is the effect of strip-mining on many Appalachian communities.

To place this in historical context, the profit rates at Indiana’s not-for-profit hospitals are larger than anything the Gilded Age robber barons were able to secure. In this observation is a final lesson.

In the process of vetting this study with several colleagues, I shared it with one lifetime Republican and veteran of two GOP administrations. His response was simply that this is the single best argument for Warren/Sanders-style health care reform he had ever seen. He is not wrong, and that alone should prompt quick legislative, regulatory and legal action.

Hicks’ editorial, along with my plight, demonstrate some of the greatest reasons for a major overhaul of our nation’s healthcare system. But let us not hold our collective breaths waiting for that to happen. It seems the health of constituents is not a priority in Congress.

About Bruce Gerencser

Bruce Gerencser, 62, lives in rural Northwest Ohio with his wife of 41 years. He and his wife have six grown children and twelve grandchildren. Bruce pastored Evangelical churches for twenty-five years in Ohio, Texas, and Michigan. Bruce left the ministry in 2005, and in 2008 he left Christianity. Bruce is now a humanist and an atheist. For more information about Bruce, please read the About page.

Are you on Social Media? Follow Bruce on Facebook and Twitter.

Thank you for reading this post. Please share your thoughts in the comment section. If you are a first-time commenter, please read the commenting policy before wowing readers with your words. All first-time comments are moderated. If you would like to contact Bruce directly, please use the contact form to do so.

Donations are always appreciated. Donations on a monthly basis can be made through Patreon. One-time donations can be made through PayPal.