Evangelicals are quite specific when it comes to God. There is ONE God, their God, the triune God revealed in the Christian Bible. All other gods are false gods. While it is increasingly common for Evangelicals to embrace Catholics as fellow Christians, it was not that long ago that most Evangelical churches and pastors believed the Roman Catholic church was the harlot of Revelation 17 and that Catholics were worshipers of a false deity. While it is encouraging to see some Evangelicals consider the thought that Catholics and Mormons might worship the same God as they do, the overwhelming majority of Evangelicals believe their God is the one, true God. No other gods need apply.

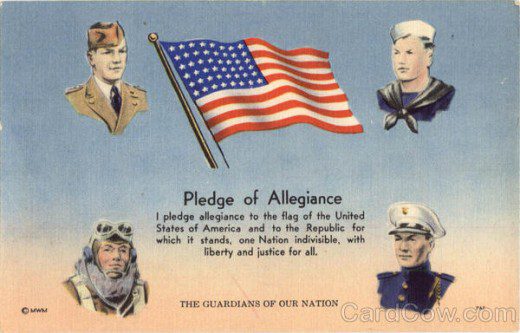

What I find interesting is how duplicitous Evangelicals can be when it comes to the mentioning of God in the founding documents of the United States, on our money, and in the Pledge of Allegiance. Evangelicals, knowing that the constitution forbids the establishment of a state church, argue before Congress and the courts that the founding fathers spoke of a generic god, that the God mentioned in the Pledge of Allegiance is no god in particular. And since the documents, laws, and the like use the word god in a generic sense, they do not violate the establishment clause or run afoul of the separation of church and state.

Yet, they turn right around, once they are away from the halls of congress and the courthouse, and say the use of the word God in our founding documents is in reference to the Christian God. They preach sermons and write books about the United States being a Christian nation. Evangelical pastors remind parishioners that the Pledge of Allegiance’s God is the Christian God, and some churches even say the Pledge on Sundays. And to some degree they are right.

Did our founding fathers have a generic god in mind when they spoke and wrote of God? The simple answer is no. Now, they most certainly did not have the modern Evangelical God in mind when they used the word, but they didn’t have the gods of Islam, Judaism, or any of the other religions of the world in mind either. Their God was the Christian God. Some of them were orthodox Christians, others were deists, but no one, as far as I know, meant anything other than the Christian God.

Why is it that Evangelicals run from this fact when they speak before congress or the courts? Why do they argue that these mentions of God are generic and not a reference to any specific god? Again, the answer is quite simple. They know admitting that these documents use the word God in a specific sense weakens their argument for their continued use. If the Pledge of Allegiance or “In God We Trust” on our money reference a non-specific God, then it makes it harder for atheists and secularists to argue that these things are unconstitutional.

It’s time for Evangelicals to start telling the truth when they testify before congress or appear before state and federal courts. It’s time they admit that the God of our founding documents and much of America’s history is the Christian God. Once they do this, we can then have a legislative and legal discussion about “In God We Trust” on our money, the Pledge of Allegiance, and the countless other places the use of the word God implies a sectarian view of God.

Whatever our country might have been in 1620 or 1776, we are not that now and our government should reflect this. Certainly, Christians are free to be legislators and judges, but their religious beliefs should not play a part when they act on behalf of the people of the United States. It’s time we return to the pre-1954 Pledge of Allegiance:

The same could be said about our paper money. “In God We Trust” appeared for the first time on paper money in 1957. Adding “In God We Trust” to our money, and adding a reference to God in the Pledge came during the McCarthy era — a time many Americans saw a “red (communist) under every bed.” Representative Charles Edward Bennett of Florida cited the Cold War when he introduced the bill (H.R. 619, a bill that required that the inscription “In God We Trust” appear on all paper and coin currency in the House) saying “In these days when imperialistic and materialistic communism seeks to attack and destroy freedom, we should continually look for ways to strengthen the foundations of our freedom.”

As the citizens of the United States increasingly embrace secularism and pluralism, perhaps it is time to throw the Christian God into the dust bin of human history.

Bruce Gerencser, 68, lives in rural Northwest Ohio with his wife of 47 years. He and his wife have six grown children and sixteen grandchildren. Bruce pastored Evangelical churches for twenty-five years in Ohio, Texas, and Michigan. Bruce left the ministry in 2005, and in 2008 he left Christianity. Bruce is now a humanist and an atheist.

Your comments are welcome and appreciated. All first-time comments are moderated. Please read the commenting rules before commenting.

You can email Bruce via the Contact Form.