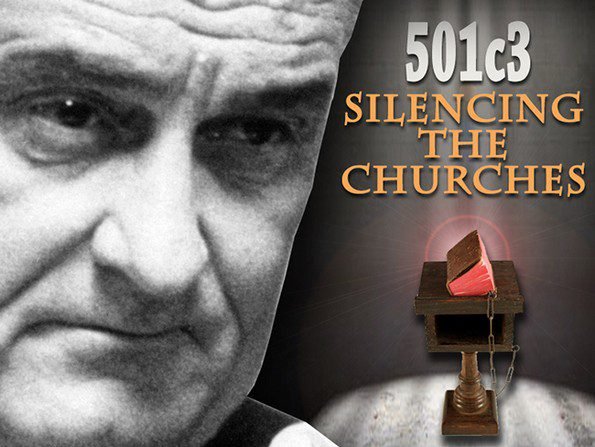

Baby Christian Donald Trump — who spent Easter Sunday honoring the resurrected Jesus by golfing all day — and his feckless band of Evangelical and Roman Catholic gatekeepers, made it known that his administration will actively go after anti-Christian bias in the federal government. Question: is there anti-Christian bias in the government to start with? No evidence is provided for bias. Christians are absolutely FREE to worship God as they wish. Christian pastors are free to preach whatever they want from the pulpit. Outside of occasional skirmishes over building codes and the Johnson Amendment, Christian churches are left alone, free to preach superstition and nonsense.

Until the early 1960s, Christians ruled the cultural roost. Then came U.S. Supreme Court rulings that banned teacher-sponsored prayer and Bible reading in public schools. Many Christians were outraged over these court rulings, saying that their religion was being persecuted. This, of course, is laughable. Public schools are secular institutions. The separation of church and state requires schools to refrain from promoting sectarian religions. When schools permit teacher-led Bible readings and prayers, they are promoting a sectarian religion — namely Christianity. Over the past five decades, Evangelical parachurch organizations have found ways to weaken the wall separating church and state by establishing student-led programs such as Lifewise Academy and Fellowship of Christian Athletes. Non-Christian organizations are permitted to offer programs to students, but so far, few do so, and those who do — such as the Satanic Temple — face pushback from Christians who do not understand the freedom of religion, free speech, and the separation of church and state. These objectors wrongly think that only Christianity should be taught in public schools. However, as things currently stand, if Christian groups are given access to school children, non-Christian groups must be given the same access.

Sadly, many school administrators, either out of ignorance or bias, support and promote Christian organizations, giving them preferential access to students. Groups such as the Freedom from Religion Foundation, American Atheists, American Humanist Association, Americans United for Separation of Church and State, and the American Civil Liberties Union spend countless hours writing letters to schools that think they can ignore the law, filing lawsuits against schools that ignore their demands. Most of the time, school districts back down and end discriminatory practices. If left unchecked, schools with Christian administrators would allow unfettered evangelization and indoctrination.

I live in rural northwest Ohio, home to God, guns, and Donald Trump. There are hundreds of Christian churches in a three-county area. I live in Ney, a town of about 356 people. There is at least seven churches within a few miles of my home. Countless local businesses have Christian kitsch hanging in their stores or tracts on their counters. Some businesses are decidedly evangelistic in their business model. One local barber claims his barber shop is a “ministry.” Get your hair cut by this barber, and you should expect to hear a sermon. Everywhere I look, I see Christianity. Maybe it is different in other places, but I don’t see anti-Christian bias anywhere.

As I type this post, I am listening to Matt Dillahunty’s Wednesday program on The Line. Matt talked about the difference between anti-Christian bias and anti-Christianity bias. Christians should be governed by the same laws as atheists. Government should be neutral when it comes to religion. Government = we the people. Not just people who meet certain political or religious standards, but all people. As citizens, however, we are free to have anti-Christianity bias. While I generally treat all religious people with respect (or with as much respect as they give me), when it comes to the organizations themselves, I am definitely anti-Christianity. I am anti-Evangelicalism, anti-Catholicism, anti-IFB church movement, and anti-any sect that causes harm to other people. I can respect my Evangelical neighbor while despising his religion at the same time. As a private person, I have the right to oppose, criticize, and condemn religious groups and their teachings. It is not anti-Christian bias if I speak out against particular sects. While it is often hard to separate the skunk from its smell — the Christian from his chosen sect — I do my best to distinguish between the two.

Donald Trump is using anti-Christian bias nonsense to curry favor with Evangelicals, Mormons, and conservative Roman Catholics. These followers of Jesus, however, are using the claim of anti-Christian bias to advance their theocratic agenda. Their goal is God rule; a nation state where Jesus rules supreme and the Bible (as interpreted by them) is the law of the land. Trump is a blowhard, but these theocratic Christians are an existential threat to our Republic. If left unchecked, the next thing we will be talking about is anti-non-Christian bias. And we already see this bias rearing its ugly head in government policies and statements made by Christian government officials.

Anti-Christian bias does not exist, but anti-religion bias does. As a secular state, the United States should not give any religion preferential treatment, but by setting up anti-Christian bias offices, the government is giving Christianity a preferred seat at the table. In a pluralistic society, every religion — including humanists, atheists, and pagans, to name a few — should be treated equally — not just Christians.

Bruce Gerencser, 68, lives in rural Northwest Ohio with his wife of 47 years. He and his wife have six grown children and sixteen grandchildren. Bruce pastored Evangelical churches for twenty-five years in Ohio, Texas, and Michigan. Bruce left the ministry in 2005, and in 2008 he left Christianity. Bruce is now a humanist and an atheist.

Your comments are welcome and appreciated. All first-time comments are moderated. Please read the commenting rules before commenting.

You can email Bruce via the Contact Form.